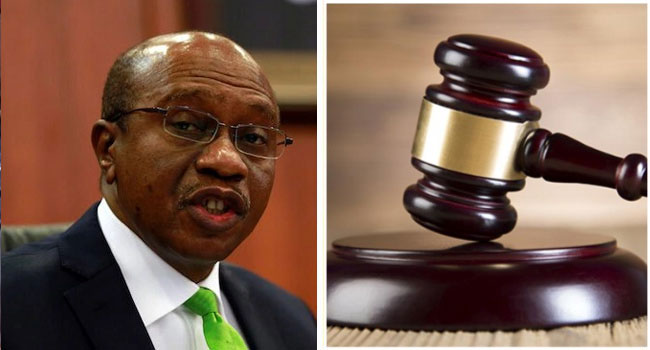

In a landmark ruling, the Federal High Court in Lagos has ordered the permanent forfeiture of properties valued at N12.18 billion linked to former Central Bank of Nigeria (CBN) governor Godwin Emefiele. The properties, located in upscale areas of the federal capital territory, were suspected to have been acquired through fraudulent means.

Justice Chukwujekwu Aneke’s decision follows a motion filed by the Economic and Financial Crimes Commission (EFCC), which had initially secured an interim forfeiture in June. The properties were traced to proceeds of unlawful activities, including fraudulent foreign exchange transactions.

Emefiele faces multiple counts of fraud and abuse of office, and the court’s ruling underscores the seriousness of the allegations. The former CBN governor’s legal situation is complex, with ongoing trials and investigations into his financial activities. The EFCC alleges that Emefiele used proxies to acquire the properties, including two current and one former CBN staff: Obayemi Oluwaseun Teben, Akomolafe Adebayo, and Olubunmi Makinde (now a former staff member).

The case has significant implications for public trust in financial institutions, eroding confidence in the integrity of the system. However, the court’s commitment to transparency and accountability is a positive step towards restoring trust. The outcome of this case will shape public opinion and influence future interactions with financial institutions, highlighting the need for robust oversight mechanisms and ethical standards.

This development also raises questions about the role of leadership in financial institutions and the need for stronger checks and balances. As Nigerians await further updates on this case, there are calls for institutional reforms and a renewed commitment to preventing and addressing corruption.

In a broader context, this development highlights the importance of transparency and accountability in public life. The case serves as a reminder that no one is above the law and that public officials will be held accountable for their actions. As the legal process unfolds, Nigerians hope for a renewed era of transparency and accountability in the country’s financial sector.