In a bid to address Nigeria’s critical housing shortage and drive sustainable economic growth, the Federal Government has approved a N250 billion real estate investment fund aimed at providing affordable, long-term mortgages for Nigerians.

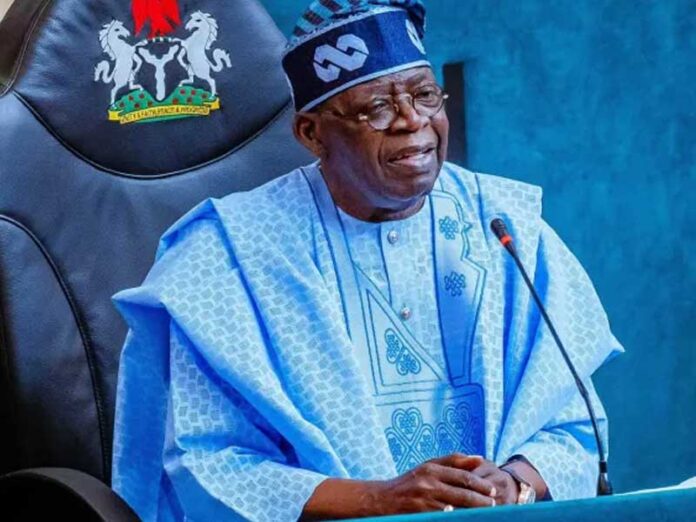

The initiative was announced by Minister of Finance, Wale Edun, following a Federal Executive Council (FEC) meeting presided over by President Bola Tinubu at the Presidential Villa, Abuja.

The newly launched Ministry of Finance Incorporated (MOFI) Real Estate Investment Fund is set to address Nigeria’s 22 million-unit housing gap, while also creating jobs and attracting private sector investment into the housing sector.

Edun stated that the fund would make low-cost mortgages accessible to individuals looking to own homes, with interest rates targeted at single-digit or low double-digit figures, bringing mortgage rates to around 11-12%, compared to current market rates that exceed 30%.

“This fund represents a foundation for long-term mortgage financing revival in Nigeria,” Edun said.

“It aims to tackle the housing deficit while fostering job creation and encouraging private sector participation in the housing construction industry.”

The N250 billion fund will be structured through a blend of government seed funding and private sector investment.

The government’s contribution will include N150 billion sourced from low-interest loans at a 1% rate with terms extending up to 40 years.

This low-cost funding will be combined with market-based investments from pension funds and life insurance companies, creating a model that reduces the cost of homeownership for Nigerians.

Edun emphasized that by leveraging both government and private capital, the fund will be able to offer affordable mortgages with extended repayment terms of up to 20 years, allowing for more manageable homeownership options for Nigerians.

“The goal is to attract long-term investors, like pension funds and insurance companies, who will inject additional capital at market-based rates.

This will allow us to offer mortgages at significantly lower rates, providing a viable path to homeownership for many Nigerians,” he added.

The MOFI Real Estate Investment Fund is a key element in President Tinubu’s broader economic strategy to stimulate growth through investments in crucial sectors.

The fund is expected to deliver significant economic benefits, with the construction industry poised to receive a boost from the influx of new investments, creating thousands of jobs and enhancing economic activity.

“This fund will be a catalyst for economic development by driving private sector involvement, job creation, and the revitalization of the housing market,” Edun stated.

The initiative also aims to attract institutional investors who can benefit from market-based returns.

Edun emphasized that the government’s role is to provide seed funding that, when combined with private sector investment, will enable mortgages to remain affordable.

“This initiative fulfills President Tinubu’s commitment to make homeownership more accessible for Nigerians,” Edun remarked.

“With this fund, millions who have struggled with high mortgage rates and short repayment terms will now find homeownership a realistic prospect.”

As the N250 billion fund rolls out, additional details will be made available to the public, with an approved prospectus ready for distribution.

Edun underscored the broader economic impact of the fund, stating, “This initiative is not just about building homes but building a sustainable future for Nigeria, with job creation, long-term growth, and a better quality of life for millions.”