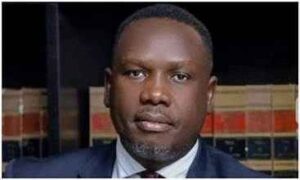

Daniel Bwala, the Special Adviser on Policy Communication to President Bola Tinubu, has criticized governors who are against the proposed tax reform bills, asserting that they are placing their revenue concerns above the welfare of Nigerians.

The tax reform proposals include the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service Establishment Bill, and the Joint Revenue Board Establishment Bill. A particularly contentious aspect of these proposals is the suggested revision of the value-added tax (VAT) distribution formula, which has faced significant backlash, especially from stakeholders in northern Nigeria.

In a presidential media chat held in December 2024, President Tinubu affirmed that the tax reform bills “are here to stay,” indicating a willingness to negotiate to address the concerns of various stakeholders.

During an interview, Bwala emphasized that the tax bills should not be viewed through a regional lens. He noted that the discussions surrounding the bills are part and parcel of the regular legislative process in the country.

“There are governors from various regions of Nigeria, not just the north, who are opposing these reforms. Some may not be as vocal, but they have shared their concerns,” Bwala stated.

“I prefer to argue this matter without the regional perspective, as that only fuels passionate disagreements.”

Bwala emphasized that the tax reform bills are set to be enacted, stressing that the debate should not be framed as a north versus south issue. “The governors will all be affected by these changes. Those from states that would see a reduction in income due to the new derivation formula are the majority, and they are not confined to the northern states.”

He acknowledged that northern governors may have been more outspoken about their opposition.

“However, amid the clamor between the governors and the federal government, it’s essential to remember that even the push for local government autonomy was not a regional issue; it was about governors concerned that such initiatives would diminish their authority. This tax reform faces similar resistance.”

Bwala urged the governors who fear a drop in their revenues to consider that the main focus should be on the welfare of the Nigerian populace, which surpasses 200 million people.

“It’s important to recognize that there are over 36 governors, plus the Minister of the FCT, totaling 37. Yet, the individuals who will benefit from these tax reforms are the over 200 million Nigerians,” he pointed out.

“An examination of the proposals reveals numerous initiatives designed to positively impact the lives of the Nigerian people.”