Manufacturers in Nigeria will continue to face high borrowing costs as the Central Bank of Nigeria (CBN) Monetary Policy Committee (MPC) has raised the Monetary Policy Rate (MPR) by 50 basis points, bringing it to 27.25% from 26.75%.

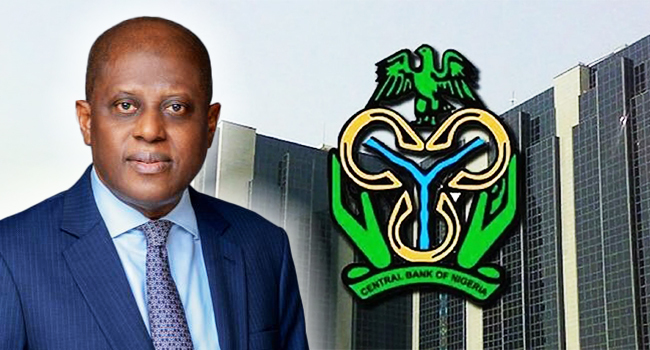

CBN Governor Olayemi Cardoso announced this decision on Tuesday following the 297th meeting of the MPC, explaining that the move was made to safeguard the progress in controlling inflation. “The decision to raise the MPR was taken to safeguard the gains that have already accrued in reining in inflation,” Governor Cardoso stated.

The MPC maintained the asymmetric corridor around the MPR at +500/-100 basis points. It also raised the Cash Reserve Ratio (CRR) for Deposit Money Banks by 500 basis points to 50.00% from 45.00% and for Merchant Banks by 200 basis points to 16% from 14%, while retaining the Liquidity Ratio (LR) at 30.00%.

Highlighting the state of Nigeria’s foreign reserves, Governor Cardoso revealed that as of September 19, 2024, the reserves stood at $39.07 billion, sufficient to cover eight months’ worth of imports for goods and services or 13 months for goods alone.

Addressing the rationale behind the MPC’s decisions, Mr. Cardoso mentioned that the committee noted a moderation in year-on-year headline inflation in July and August 2024, as well as relative stability and convergence in the exchange rate across market segments due to the bank’s tight monetary policy. This stability, he said, would improve confidence and enable better economic planning in the medium to long term.

However, he acknowledged that further efforts are needed to achieve the bank’s price stability mandate. While there was a downward trend in food inflation, core inflation remains elevated, driven primarily by rising energy prices. “The uptrend poses severe concerns to Members, as it clearly indicates the persistence of inflationary pressures,” Cardoso stated.

The MPC emphasized the importance of collaboration with fiscal authorities to address rising energy prices and curb excess liquidity in the system, which is impacting foreign exchange demand. Additionally, members expressed concerns over the growing fiscal deficit but noted the fiscal authority’s commitment to avoid monetary financing through Ways & Means.

The committee also observed a strong correlation between Federation Account Allocation Committee (FAAC) releases and liquidity levels in the banking system, which impacts exchange rate fluctuations. Therefore, the MPC agreed to increase monitoring of future releases to address their effects on price developments.

Governor Cardoso further stated that the CBN is working to restore credibility and trust in the institution by refocusing on its core mandate. “We are fully engaged in getting ourselves out of unorthodox means of running the central bank,” he said, adding that these efforts have contributed to improved ratings from international agencies.

Financial experts have noted that the MPC’s decision to further tighten the monetary policy rate is likely based on evidence of significant threats to the exchange rate and inflation.

They stressed the need for joint efforts by monetary and fiscal authorities to tackle inflation and urged the government to focus on controlling recurrent spending and boosting productivity, particularly through support for small businesses.