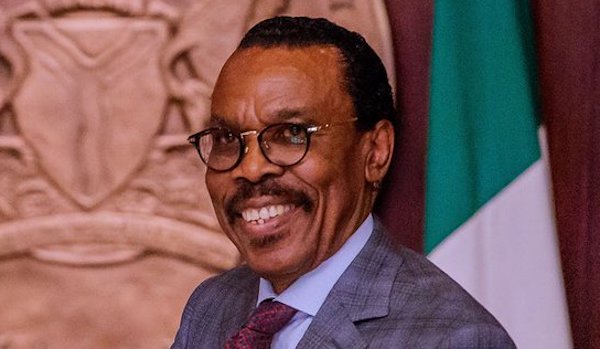

Bismarck Rewane, the CEO of Financial Derivatives Company Limited, has expressed concerns about the potential economic consequences of increasing Nigeria’s minimum wage without a corresponding increase in productivity.

Rewane emphasized that simply raising the minimum wage without improving productivity is akin to printing more money, which can lead to inflationary pressures.

He referenced the Minimum Wage Act of 2019, signed by former President Muhammadu Buhari, which exempted employees in firms with fewer than 25 workers from the ₦30,000 minimum wage requirement.

This act, set to expire in April 2024, should be reviewed every five years to align with the current economic demands of workers.

Rewane highlighted the legal obligation for employers with 25 or more employees to adhere to the minimum wage regulations. Failure to comply can result in substantial fines, with a penalty of ₦75,000 and an additional ₦10,000 for each day of non-compliance.

He stressed the need to consider the overall wages paid in the country in relation to the productivity and output of the workforce, as well as the wealth of the nation.

The CEO pointed out that increasing wages without a corresponding increase in productivity, especially in a context of power and infrastructure challenges, can have significant implications for the economy.

He urged the government and relevant stakeholders to address this issue promptly, as time is of the essence and the situation is becoming urgent.

In his Democracy Day speech, President Bola Tinubu assured organized labor that an executive bill on the new national minimum wage would be sent to the National Assembly for consideration.

The President will carefully evaluate the ₦62,000 proposal put forward by the government and private sector, as well as the ₦250,000 demand from organized labor, before making a decision.