The National Association of Nigerian Students (NANS) calls on the Nigerian government to reverse a new charge on electronic money transfers. This new rule will require people to pay N50 (around USD 0.12) for any electronic transfer of N10,000 (around USD 24) or more done through fintech companies.

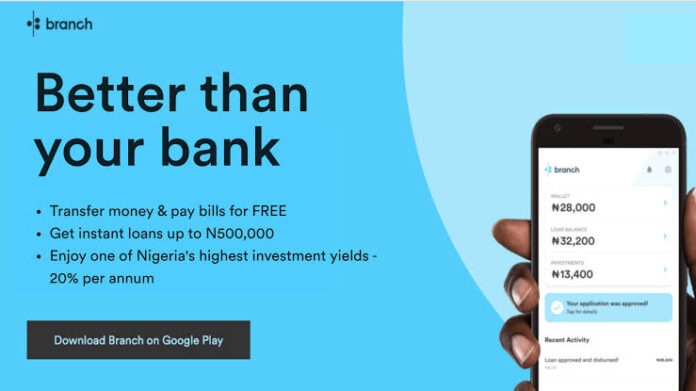

Fintech companies are businesses that provide financial services through technology, such as mobile apps. These companies have become popular in Nigeria because they often offer lower fees than traditional banks. However, the new N50 charge will eliminate this advantage for many Nigerians.

Why are Students Upset?

Students are particularly upset about the new charge because many of them rely on electronic money transfers to pay for their education and daily expenses. The N50 fee could significantly reduce the amount of money they have available for essential needs such as school fees, textbooks, and food.

What is the Government Saying?

The Nigerian government says that the new charge is a way to raise additional revenue. The money collected from these fees will go to the federal government.

What is NANS Saying?

NANS argues that the government should find other ways to raise revenue, such as investing in agriculture, education, and infrastructure. They believe that the new charge is an unfair burden on students and ordinary Nigerians.

What Happens Next?

It is unclear at this time whether the Nigerian government will reverse the new charge. NANS is calling on the government to reconsider the policy, but it is not yet known if their pleas will be heard.

This situation shows the tension that can exist between the need for the government to raise revenue and the desire to keep costs low for citizens. It will be interesting to see how this situation unfolds in the coming weeks and months.