A former NNPC Director has revealed Nigeria’s global gas export share fell from 15% to 2%, called for sector investment.

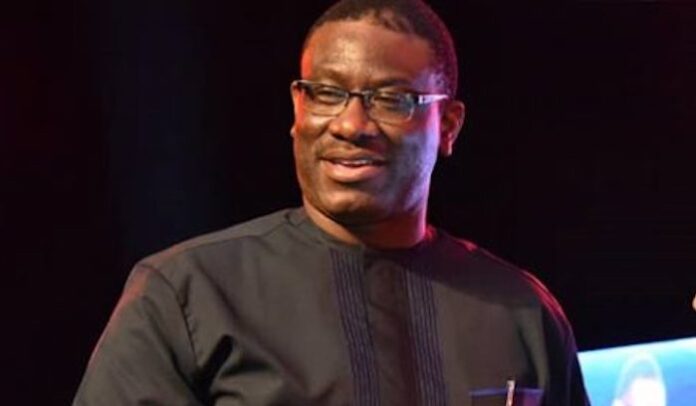

Despite owning the world’s 9th largest reserves of natural gas, with over 209 Trillion Cubic Feet (TCF), Nigeria’s global market share of exports has declined from 15 percent to just 2 percent in recent years, a former Group Executive Director, Gas & Power, at the Nigerian National Petroleum Company Limited (NNPC), Dr David Ige, has disclosed.

Ige, who was a panellist at the Babalakin & Co organised gas colloquium in Abuja, also stressed that Nigeria’s much-talked-about gas master plan meant to ramp up production and supply of the commodity, was still stuck in phase one, 18 years after its take-off.

Ige, who now runs Gas Invest Limited, argued that from 2017 to 2023, Nigeria only grew its domestic gas market by about 1.3 million cubic feet per day to around about 1.5 to 1.55m CF, representing just 3 percent annual growth rate, while gas export has also declined.

The Nigerian Gas Master Plan was devised as a major interventionist concept to move the gas sector from its essentially dormant status in 2006 to a market-based system with willing sellers and willing buyers, realising the full potential of the sector for the benefit of all Nigerians.

Ige said: “On aggregate, we really haven’t grown gas in the last seven years as a country. That’s by virtue of our performance today. But let’s even take the domestic market growth. We have grown at about 3 percent. And the 3 percent growth is evident also in the challenges of the pipeline. Because the pipeline is barely operating at a steady state, which is very symptomatic of a lack of supply basically to the system.

“So all of these point to a generally low level of investment in Nigeria, regardless of what we have done in the Petroleum Industry Act (PIA) or in everything else. The key point is the PIA is a necessary but not a sufficient condition to attract investment. And I think that’s very important because we focus so much on the PIA.

“It’s a law. But there’s a whole plethora of things that actually make investments to happen. And it’s important that we get all those together. With 210 TCF of gas, Nigeria should be operating in a slightly different frame from countries that operate one project at a time. So we need to take this very holistically because we spend too much time talking about our 210 TCF.

“I think it’s time we start talking about how much of that gas is actually working for us. Now, in the US, between 2017 and 2023, just the export component of the US market grew from zero to 12 BCF and growing steadily. That’s on a compounded basis of about 37 to 40 percent year-on-year, compared with our 3 percent or less in Nigeria.”

According to him, Nigeria should begin to look at how to move the sector forward in a big way, rather than focus too much on the little things that tend to bog it down, noting that while the country has a humongous amount of reserves, they are hardly ever accessible, unlike in the US where reserves accessibility is not a major challenge.

“Nigeria has a lot of reserves, but they’re not accessible. I remember when we did the gas master plan many years ago, one of the slides we put together broke down the reserves of the country, the ones that are stranded, the ones that are accessible.

“There’s a lot of gas reserves in Nigeria that are actually stranded, either in the hands of independents who are fighting each other, or they’re in the hands of International Oil Companies (IOCs), that are sitting on the assets. They’re not developing them, but they’re not able to access it,” he argued.

However, in terms of fiscal terms, the former top NNPC official stated that Nigeria has done well, assuring that the country is soon going to see the benefit of that.

While it is good to invest in infrastructure, he argued that it must not be done in isolation of the benefits of the market because the market is what’s going to drive its viability.

“Our biggest competitor in Europe is the US. Our market share in energy has dropped from 15 percent to 2 percent globally over the last couple of years. And probably going further down.

“Every time you talk about a market-led price, there is a wrong conception that it will automatically transmit to higher prices. A market-led price is going to lead to the optimal and equilibrium price, which is not necessarily lower or higher.

“It could be either way. And quite frankly, if we have the market liberalised today, the prices will be lower than the price that the regulator sets on top of it,” he maintained.

Ige stressed that it wasn’t just about scouting for foreign investment, but also looking at the cost of doing business.

“It’s not just saying we want investment. It’s about creating the cost environment. This whole security thing. We’re building pipelines. The capex of a pipeline is about 40 percent higher just because of security, community, etc,” he added.

Stressing that the gas market in Nigeria was still very shallow, Ige stated that the global market does not care where the commodity is coming from, but is only looking for the cheapest gas that is available.

In designing the price and policy during the gas master plan, he said three things were under consideration, including the interim destination and the destination that allows the country to move into a fully liberalised market.

“Now, where we are today, we are stuck in year one because we didn’t move to that liberalised market. But the master plan was supposed to have moved there and to have done things to make that happen,” he argued, stressing that the entire aspiration has been undermined by the power sector.

Also speaking, Chief Executive of UTM Offshore, Julius Rone, agreed that Nigeria has a lot of stranded gas sitting offshore that it can monetise for the benefit of the country.

“And we look at it and say, look, the only way to monetise this stranded gas is to get a solution that has been proposed, that is working all over the world. It’s quite interesting that Nigeria should have had a floating LNG a couple of years back, but a lot has happened that have delayed Nigeria from having it.

“But today, an indigenous company is partnering with a national oil company to put up Nigeria’s first floating LNG. And we believe that this project is of immense benefit, in line with the government initiative to increase our gas development. Most importantly, the project is not just to serve international market, but is to support domestic market,” he said.

In his remarks, Chief Investment Officer, NNPC Gas & Power Investment Services, Salihu Jamari , noted that even before 2021, when the ‘Decade of Gas’ initiative was launched, government and the NNPC had been making serious effort to make sure that the gas resources was utilised for Nigeria’s domestic development.

“In the upstream side, adequate consultation have been done by all the stakeholders to see what can you do to be able to meet this target. Projects are identified. New ones are identified.

“And also (we are looking at) what is hindering the fast-track to make sure that these projects are completed and also identified. Risk mitigated plans have been developed,” he said.

Also speaking, Chief Investment Officer, IBTC Infrastructure Fund, Dolu Olugbenjo, stated that the sector needs long-term capital, which he said led to the floating of an N84 billion investment fund by the bank.